I'm Meg DeLuca. I'm a partner in the Stanford office of Comings and Lockwood. My topic is when and to whom does a trust pay income tax. The basic point of this conversation is really when what states are permitted to tax a trust. So we're gonna be focusing on how states tax various trusts and what types of connections the state has to have to those trusts in order to tax the trust for income tax purposes. For purposes of our discussion, we're gonna talk about two types of trusts. The first one is grantor trusts. As you may know, a grantor trust is a trust where the income earned in the trust is taxed back to the grantor on the grantor's individual income tax return. The second type of trust is a non-grantor trust. There are subcategories to that, but it doesn't really matter for this discussion. But I'm gonna tell you what they are. One is a simple trust, which basically requires that all the income go out to the beneficiaries. And then there's a complex trust, which is anything that's not a simple trust for purposes of grantor trusts. According to state law, if a trust is treated as a grantor trust for federal income tax purposes, it is almost universally treated as a grantor trust for state income tax purposes. Which makes it very easy for us to understand their laws regarding taxation of state and states of grantor trusts. There are two exceptions, they're not very notable, but Alabama does not recognize grantor trusts unless the trust is a revocable trust, and Pennsylvania recognizes grantor trust, but not if it's a grantor trust as to the beneficiary of the trust. I'm not gonna get into the details of that because we're gonna put grantor trusts aside....

Award-winning PDF software

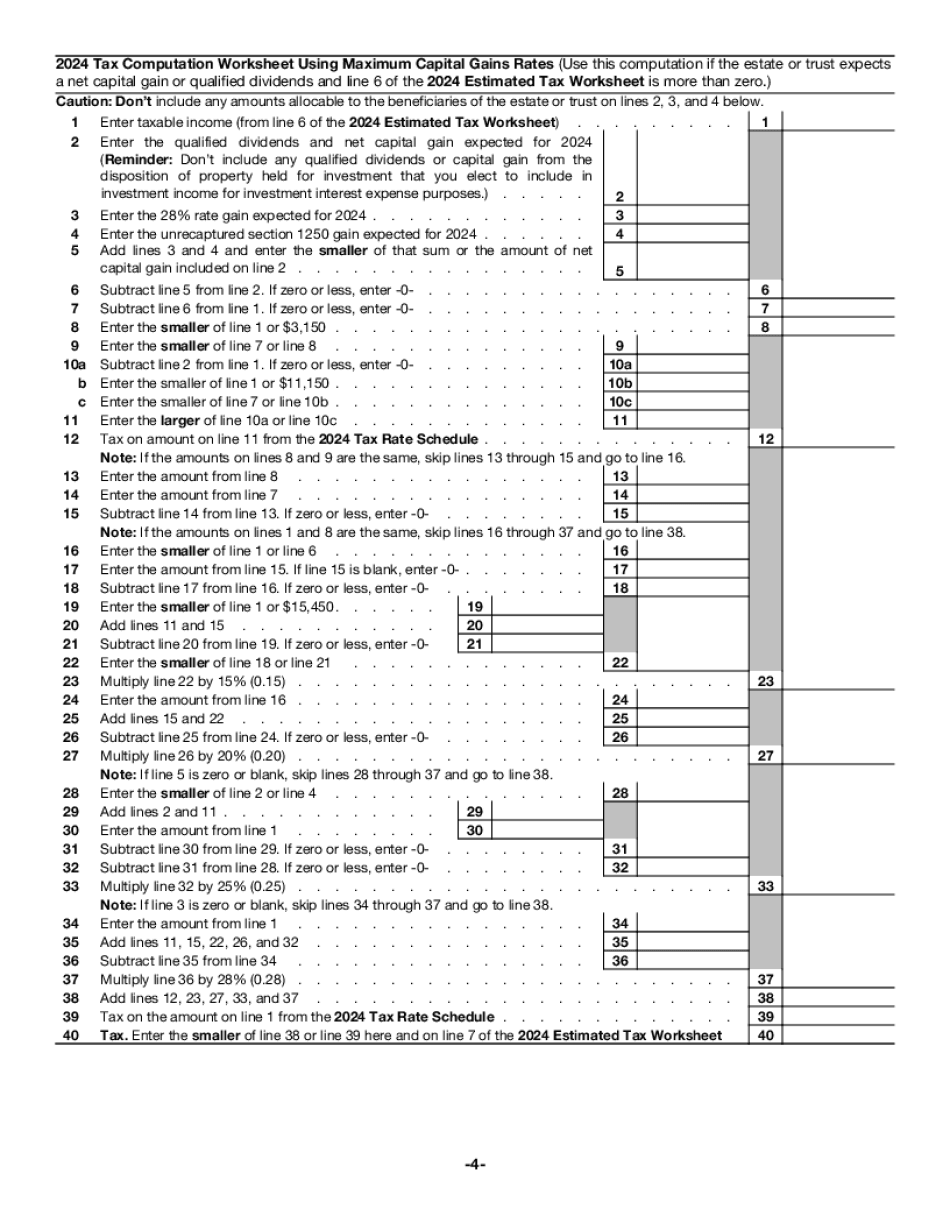

2024 trust estimated tax payments Form: What You Should Know

When filing your personal income tax return for the calendar year, include Form 1-2 in your account. Form 1-3 Instructions for Estates and Trusts (Part II), if your estate or trust has a beneficiary with an estate-controlled trust you can use for 2018 Fiduciary Income Tax — Louisiana Department of Revenue If you will pay income tax or estate tax this year, complete an additional Form 1-1 for all tax years for which you will pay income tax or estate tax. For information and forms on filing and paying income tax for 2018, Loretta Williams S.J., Estate Planner, (Office of the Executive Director) (Office of the Executive Director), Fiduciary Income Tax — Louisiana Department of Revenue If you will pay personal income tax this year, complete an additional Form 1-3 for all tax years for which you will pay income tax. For more information, use Loretta Williams S.J., Estate Planner, (Office of the Executive Director) (Office of the Executive Director) 1.85 percent on the first 18,000; 3.5 percent on the next 18,000; 4.25 percent on the amount over 18,000 and your spouse's income (if any). Declaration of Estimated Tax. Estate or trust. 2.35 percent each payment of 12,000. For an estimated tax for an estate or trust, complete this form for each tax year in which you have received income from the estate or trust. This filing procedure also includes making estimated tax payments prior to filing 2018 Personal Income Tax Return (Form 1-2A) Form 1041-ES, Estates and Trusts, Fiduciary Income Tax Payment Voucher Loretta Williams S.J.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1041-ES, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1041-ES online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1041-ES by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1041-ES from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 trust estimated tax payments