Award-winning PDF software

About Form 1041-Es, Estimated Income Tax For Estates And Trusts: What You Should Know

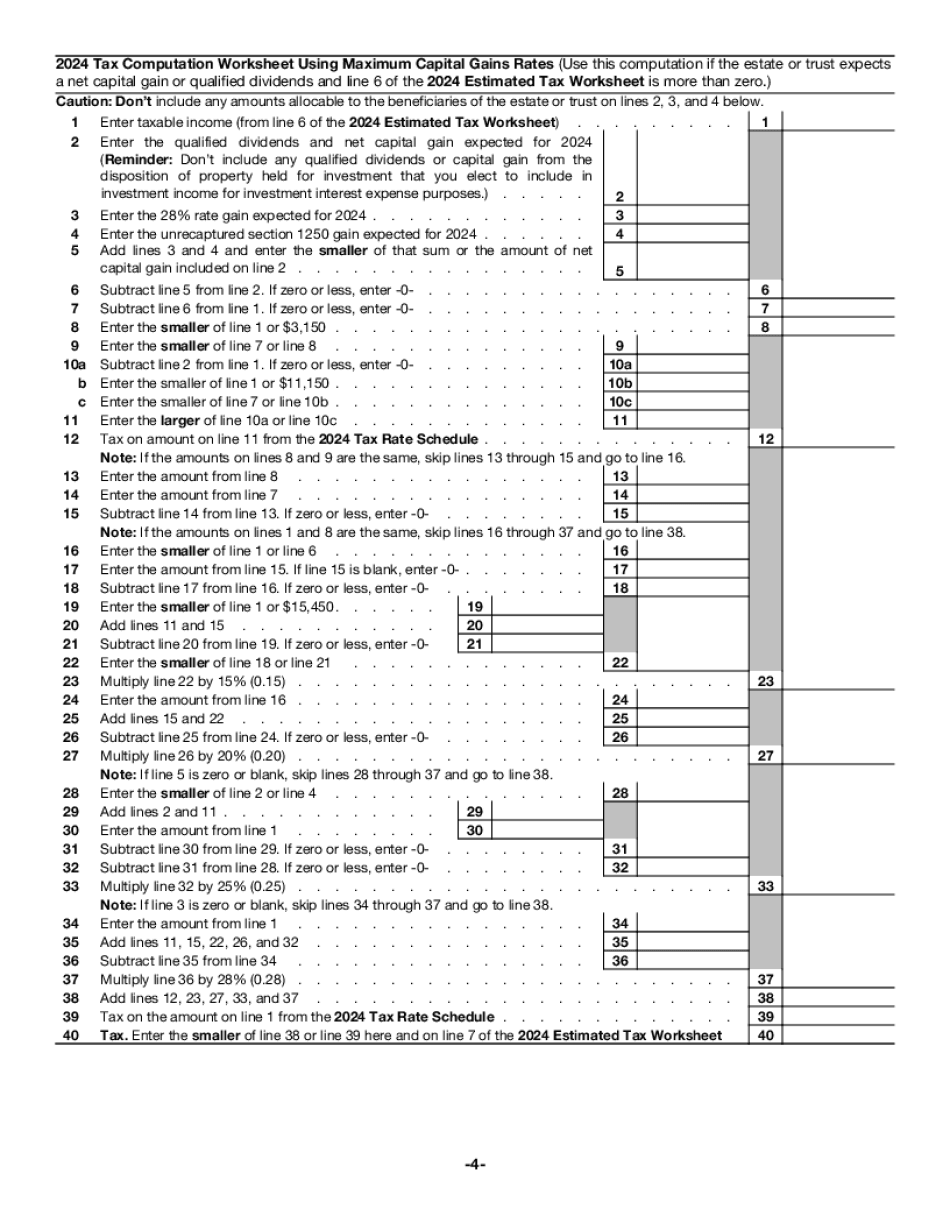

If applicable, this form is used to determine the amount of the Estates or Trusts contribution tax. It also should help the estate or trust determine the estimated tax payment. Do not use the form if you are a qualified beneficiary whose sole source of income is pensions. For more information, see Form CT‑1041ESS. 1041ES-PRINTED FOR ONLINE USE Estates and Trusts CT-1041ES_1219.pdf (PDF, 16 p.) — Form CT‑1041ES (for estates and trusts) The 2025 and 2025 Estimated Income Tax Schedule forms available online or by using the PDF form to print may not be for the 2025 or 2025 tax years. The new forms are for the 2025 tax years. For more information, see Estates and Trusts.

Online solutions assist you to prepare your document administration and enhance the productivity of your respective workflow. Observe the quick help in order to finished About Form 1041-ES, Estimated Income Tax for Estates and Trusts, steer clear of mistakes and furnish it inside a well timed fashion:

How to complete a About Form 1041-ES, Estimated Income Tax for Estates and Trusts on-line:

- On the website aided by the type, click on Launch Now and go for the editor.

- Use the clues to fill out the relevant fields.

- Include your own information and facts and speak to knowledge.

- Make convinced you enter appropriate details and numbers in suitable fields.

- Carefully take a look at the articles of the form in addition as grammar and spelling.

- Refer to help part for people with any doubts or deal with our Aid workforce.

- Put an digital signature on your About Form 1041-ES, Estimated Income Tax for Estates and Trusts using the guidance of Sign Resource.

- Once the shape is accomplished, push Carried out.

- Distribute the completely ready type via email or fax, print it out or save on the product.

PDF editor allows for you to definitely make changes to your About Form 1041-ES, Estimated Income Tax for Estates and Trusts from any on-line linked product, customise it as outlined by your requirements, signal it electronically and distribute in numerous means.