Award-winning PDF software

Printable Form 1041-ES Santa Clarita California: What You Should Know

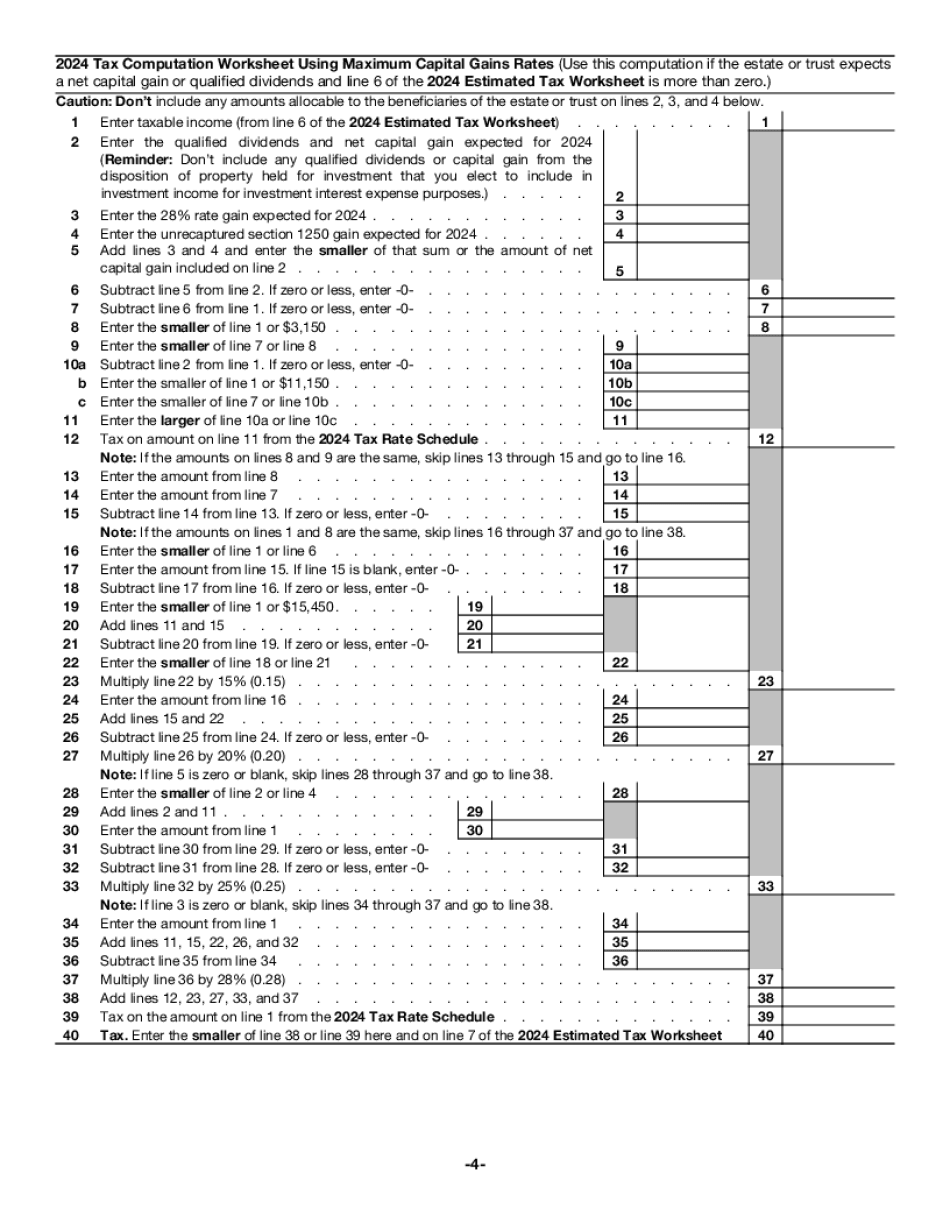

Estates and Trusts, for all Forms and Instructions (PDF). 2015 Department of the Treasury Internal Revenue Service Form 1065 Estimated Income Tax (Form 1041). Fill the rest with whatever you find handy. For our family this is what they use— Use our template to fill out Form 1062, Individual Income Tax Return, for Estates and Trusts (PDF) — IRS Form 1065 Estimated Income Tax. These form may be familiar to you as the American Income Tax Return for Estates and Trusts. If a trust or estate reports the expenses and income, they use this form. If you work for a business and want to make any adjustments, we recommend the 2025 Form 1065 Estates and Trust Return (PDF). This file may take as long as an hour to fill, but it does not involve any printing or printing costs. Just print the pages that interest you and sign them right away. Use our template to fill out IRS Form 886-EZ, Alternative Minimum Tax. Fill the remainder with the form, if any, with whatever other information you may have. Then fill the rest with whatever data you find handy and attach it, before sending it off with the rest to the IRS. There is nothing complicated about using these tools to prepare a federal income tax return online. The only things to be aware of are the fact that the IRS will not accept the returns for filing online until April 10. The deadline to file is now April 17, but you can file all the forms now and get them in by Thursday of that week if you do them all in the same day! And if you have any questions feel free to call us at. We'd love to help you. If the IRS wants to see your returns, you will have to file them directly with them as a paper tax return. They may take up to 12 weeks to get them back to them. Don't wait because if you do it too late they will charge you 2,000.00 filing fee. If you already file your return online before April 10, you will then have to file it again in person at a local IRS Tax Examiners office in person. Use our template to fill out Form 943 Instructions for Claim of Child Tax Credit (PDF). Fill the rest with the form, if any, with whatever other information you may have.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1041-ES Santa Clarita California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1041-ES Santa Clarita California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1041-ES Santa Clarita California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1041-ES Santa Clarita California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.