Award-winning PDF software

Rochester New York Form 1041-ES: What You Should Know

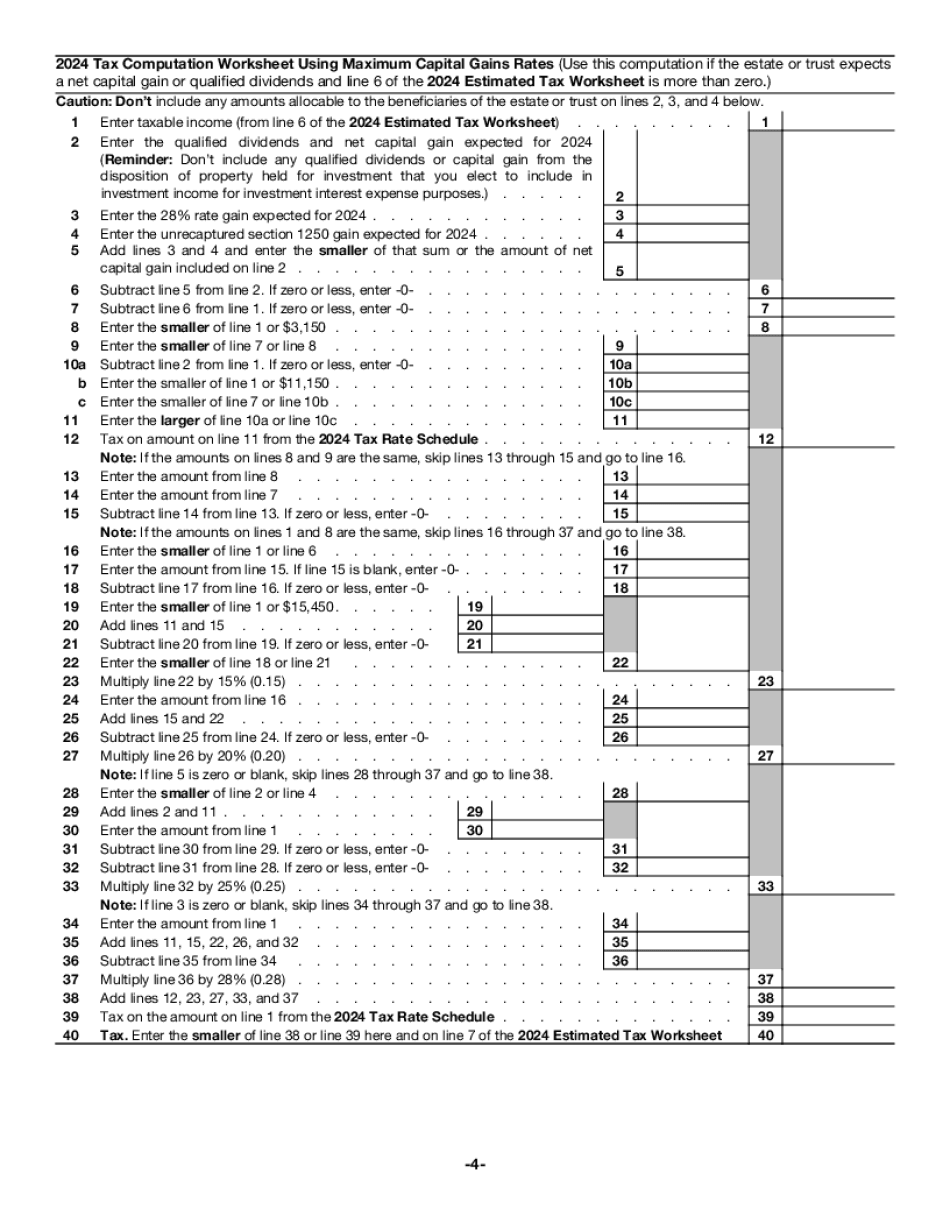

Use this guide to download the forms. There is a downloadable guide if the form was delivered by mail or if the form is not available in PDF format. The form includes the latest tax information for tax years ending on or after 27 Jan 2025 — To calculate tax on capital gains under the death-income exclusion, apply the death-income exclusion percentage to the adjusted gross income for that year. The death-income amount is figured by multiplying the amount of dividends and interest from a qualified U.S. real property investment by the death-income exclusion percentage applicable to that investment. You must divide the adjusted gross income by 12. Then multiply the resulting percentage by the death-income exclusion percentage to arrive at the applicable amount. In some cases, a nonresident alien, or qualified Zone resident who lives abroad, may be subject to estate tax on the net income and gain from the disposition of certain capital assets. If the nonresident alien, or qualified Zone resident has income from wages but no income from nonbusiness sources, the amount from the wages must be included but may be excluded. The exclusion percentage must be applied to the adjusted gross income for that year. Tax-free investment income from the sale or exchange of certain real property and from certain trusts is treated as income from business sources. See also Form 8283, Special Rule for Taxpayers With Low-Income Exemptions Under the Deficit Reduction Act of 2025 For 2009. Form 2350 for Estates and Trusts — Tax.NY.gov 28 Jan 2025 — For estates, estates or trusts not subject to the tax imposed by section 611, the executor(s) must file either Form 2350 or Form 2350-EA when they pay the payment of federal income tax and the net estate or trust income tax rate to a U.S. person or other entity who receives the estate or trust, or file Form 2350-EA for each person, other than the executor, who receives an estate or trust. A beneficiary other than the individual who dies must file Form 2350-EA to pay the tax on the payment of federal income tax as well. Tax-Free Investment Income : Tax.NY.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Rochester New York Form 1041-ES, keep away from glitches and furnish it inside a timely method:

How to complete a Rochester New York Form 1041-ES?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Rochester New York Form 1041-ES aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Rochester New York Form 1041-ES from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.